Research Only: How Academic Tourism Went Online and Why Scholars Like It

On October 23 – 24, 2020, the IX International Moscow Finance Conference will take place. The event has been organized jointly by ICEF and the London School of Economics. This year, the list of participants includes the editors of the two biggest journals in economics. Alexei Boulatov, Tenured Professor of HSE University, spoke about how the online format influenced the quality of academic events, what has changed in academic life over the last few months, and the topics that interest researchers today.

Why the Conference Is Not Following the Current Trend

The conference organizing committee, which includes me, ICEF Associate Professor Vladimir Sokolov, and LSE Professor Christian Julliard, hasn’t had any disagreements on this from the very beginning. We don’t believe that the news agenda or global trends can determine the focus of fundamental research. That’s why our conference is not about COVID-19, and one shouldn’t expect it to react to what is happening in the world right now.

Academic thought develops according to its own logic, which does not depend on any trends. That’s why our first aim as we were compiling the conference programme was to invite strong researchers from different areas of financial economics – corporate finance and asset valuation – in empirical and theoretical studies.

And we have succeeded. This year, our speakers are very interesting and authoritative: they have taken an interest in ICEF as a young and growing academic community. The conference’s transition to online mode has also played a selective role of sorts in terms of participants.

How the Online Format Became a Quality Factor

A conference traditionally includes air travel, introduction to the university, excursions, and lunches. Academic tourism has always been a part of the academic community, even a favourite part for some. Today, conferences are no longer a source of entertainment but are focused exclusively on research instead.

I believe that those who remain academically active are our target audience. Such ‘selection’ has improved the event quality considerably: our participants are outstanding academics for whom interaction with the ICEF academic community has turned out to be most important thing.

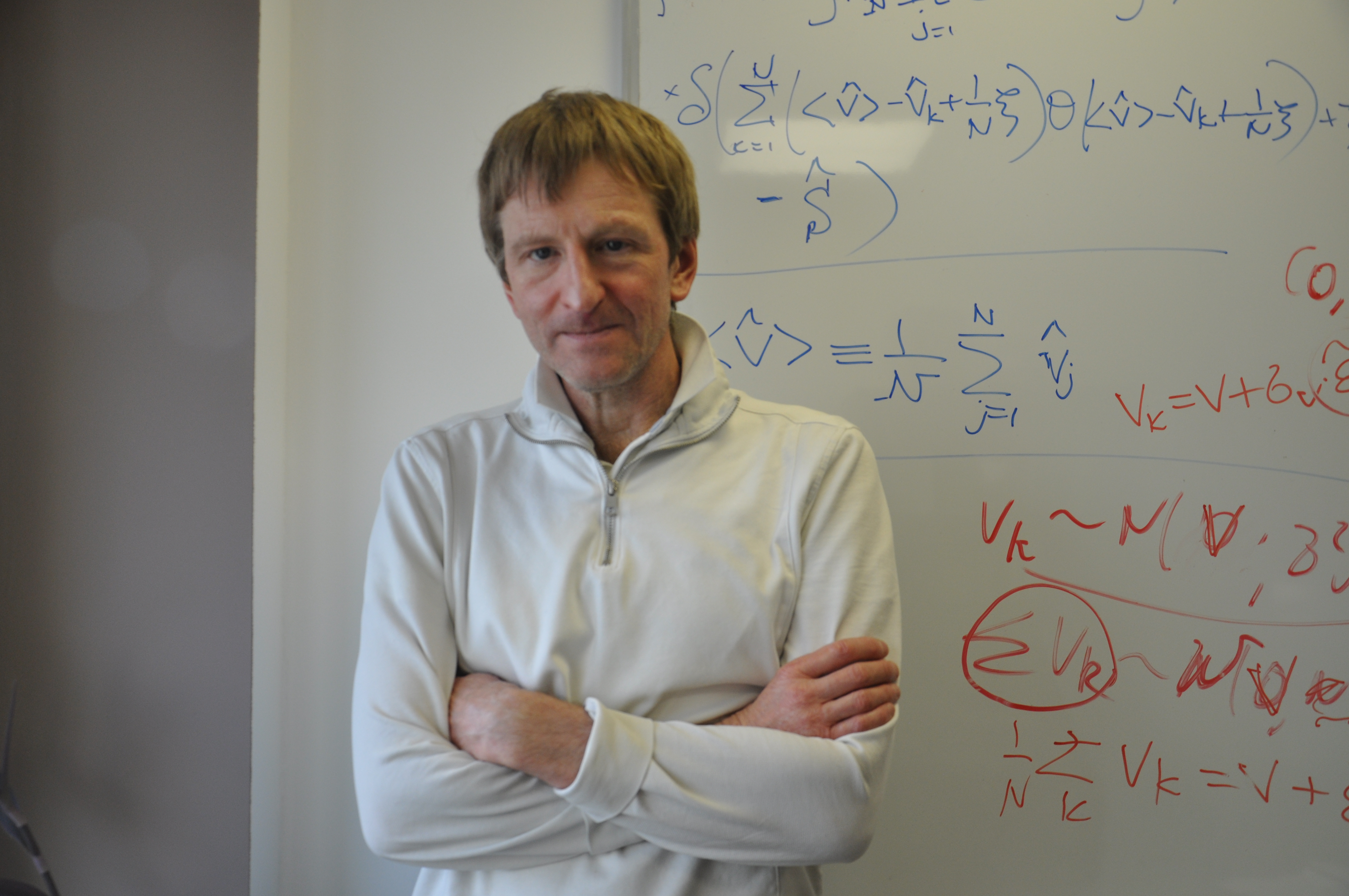

Vladimir Sokolov, ICEF Associate Professor, member of the conference organizing committee

Our conference’s reputation has played a major role in our ability to attract such outstanding speakers. Despite its ‘low-key’ character, the ICEF International Conference in Financial Economics is a special event in academia, and many of the papers presented at it are later published in top academic journals.

Over the two days, we’ll have presentations by very influential scholars from USA and Europe, as well as two colleagues from ICEF: Sylvain Carré and Dmitry Makarov. Due to the time difference, we had to reduce the programme so that the conference doesn’t take place at night. Many of our colleagues will take part as discussants, which is also a very important option for gaining feedback and ensuring the success of future papers by our participants.

Unexpectedly enough, we are focusing on banking this year: about 80% of our time will be spent discussing banking-related issues. Academic understanding of the processes is taking place fundamentally, and the consequences of the 2008 crisis are still being actively researched. The phenomenon of the current crisis will be explained by scholars years later. The mechanism of financial institutions’ impact on the real sector is not yet completely understood, and I believe that we’ll shed some light on it at the conference.

The online format, undoubtedly, has its shortcomings: the university as a real place with its unique atmosphere and people who aren’t participating in the conference but who are nevertheless an important part of the research community are literally left off the screen. In the future, we’ll attempt to combine formats, since the social aspect is extremely important: offline events already have a certain culture, traditions, even a code of conduct, which has already become part of the academic environment.

What to Expect from the Conference

Participants will present their most recent research and share the ideas they are working on. It has been a pleasure to notice how ICEF is able to attract some really outstanding people and has built a really strong network in the academic community.

The conference programme includes at least two editors of top academic journals in financial economics: Toni Whited from the Journal of Financial Economics and Itay Goldstein from the Review of Financial Studies. Christopher Hennessy from the Review of Financial Studies recently spoke at ICEF, but unfortunately he won’t make it to this year’s conference.

My research interest is financial market microstructure, and I will be particularly interested in the presentation by Haoxiang Zhu, MIT Sloan School of Management, a young speaker in this field who we have been looking forward to hearing at conference for a few years. Among other things, he is studying high frequency trading – and this topic is highly relevant today.

Along with ICEF researchers Sylvain Carré and Vincent Fardeau, we are looking into this phenomenon: our assumption is that in trading information is not as important as liquidity. Unlike Zhu, we’ve taken the path of analysing high-frequency trading algorithms from the perspective of their optimal operation speed. In addition, I work with financial industry professionals, such as BlackRock: for me, such connections are essential in research. By the way, many of these professionals are former physicists, such as one of my co-authors from Berkeley, so we speak the same language.

How the Lockdown Has Changed the Way Scholars Work

Since all research work is built on communications between co-authors, the last few months have undoubtedly had a negative effect. In addition, it is a challenge for many to live and carry out research in one place, in one environment. Over the long term, these months will have a certain effect, but today, many scholars feel a sense of euphoria because they are able to participate in three conferences in a week. However, nothing can replace human communication with real exchange of energy and emotions.

It’s time to invent new ways to conduct convenient, but safe discussions

Communications and the ways to deal with time have changed in society at large, and not just in the academic community: professional events are held in more effective and user-friendly formats. Time is particularly valuable for researchers, and a new ‘product’ is necessary for their personal interaction. Like everything in the world, even academic conferences are expecting modernization

See also:

‘Teaching Is a Learning Experience for Me—Every Question Is an Opportunity to Update My Lecture Material’

Kemal Kivanc Akoz is an Assistant Professor of the Department of Theoretical Economics at the Faculty of Economic Sciences. He has been at HSE University for six years and his current activities include research into marriage market dynamics and information agreements among groups of agents. In this interview with the HSE News Service, Kemal talks about the subjects of his research, the teaching approach that led to him being named one of the university’s Best Teachers, his favourite places to get a coffee in Moscow, and more.

‘I Hope You Have Entered the Economic Profession Consciously’

On November 11, 2024, the HSE Faculty of Economic Sciences hosted a celebration for Economist Day. Many of the university's partners came to congratulate HSE on the occasion. The atrium on Pokrovsky Bulvar hosted booths from VkusVill, Ozon, HeadHunter, Wildberries, and other leading companies. Students and professors participated in quizzes, spun the wheel of fortune, painted, and crafted.

Maxim Reshetnikov: ‘An Effective Open Market Economy Has Been Built in Russia’

On November 11, 2024, during Economist Day in Russia, Maxim Reshetnikov, Russian Minister of Economic Development, spoke to students of the HSE Faculty of World Economy and International Affairs about Russia’s foreign economic activities, how the country managed to withstand unprecedented sanctions pressure, and the current state of its development.

FES Announces the Winner of the Nobel Prize in Economics 2024 Prediction Contest

The HSE Faculty of Economic Sciences summarised the results of its traditional prediction contest. FES holds this contest annually on the eve of Nobel Week. This year, the contest once again attracted participants from different regions of Russia and countries around the world. Remarkably, one participant managed to predict all three laureates of the 2024 Economics Prize.

Try Your Hand at Predicting the 2024 Nobel Prize Winner in Economics

The Faculty of Economic Sciences is launching its annual prediction contest. On October 14, the Nobel Committee will announce the winners of the Sveriges Riksbank Alfred Nobel Prize in Economic Sciences live on air. You have time to prepare and explore the landscape of contemporary economic thought. What topics and areas are considered particularly important and promising at the moment? Anyone can win.

Choosing the Right Server Results in Better Outcomes in Doubles Tennis

The Roland Garros tennis tournament, one of the most prestigious in the world, began on May 26. The prize money for this year's French Open totals nearly 54 million euros, with athletes competing in both singles and doubles events. In doubles tennis, choosing the right strategy for a match is crucial. Athletes' ability to adapt to the dynamics of the match and strategically choose the server can earn the pair up to 5% more points, according to Nikolai Avkhimovich, doctoral student and research fellow at the Laboratory of Sports Studies of the HSE Faculty of Economic Sciences. A paper with the study findings has been published in Applied Economics.

Consumer Prices Decrease in Densely Populated Areas

HSE University economists have proposed a novel approach to modelling monopolistic competition with heterogeneous firms and consumers. The results of collaborative research carried out by Alexander Tarasov from Moscow, his co-authors from HSE University–St Petersburg, together with the Norwegian School of Economics, the University of Pennsylvania, and the Free University of Brussels, have been published in American Economic Journal: Microeconomics.

Football Players Cover Greater Distances During Critical Derby Matches at Home Arena

Researchers at the HSE Faculty of Economic Sciences examined the level of effort that professional football players are willing to exert during a match in absence of financial incentives. It appears that the primary factors driving players to strive harder for victory are the strength of the opponent and the significance of the match for the club. This is particularly noticeable in derby matches between teams from the same city, such as the Moscow derby between CSKA and Spartak on April 25, 2024. The study has been published in the Journal of the New Economic Association.

Participation in Crowdfunding Can Generate up to 73% in Returns Annually

Backers of projects on crowdfunding platforms can expect rewards from their pledges. For example, funding someone's idea on Kickstarter can result in an average annual return of 11.5%, with design projects known to deliver returns as high as 70%. However, it is important to note that these returns do not come in the form of direct cash payments but rather as savings on the purchase of the product once it hits the market. This has been demonstrated in a study by researchers at the HSE Faculty of Economics published in Economic Analysis Letters.

Economists Suggest Using Media's Attention to Bitcoin to Predict its Returns

Researchers at the HSE Faculty of Economic Sciences have studied the relationship between the changes in the bitcoin prices and the media attention to this cryptocurrency. The researchers examined the mentions of bitcoin in the media between 2017 and 2021 and built a mathematical model that revealed the strong relationship between media attention and bitcoin prices. The study was published in the Applied Stochastic Models in Business and Industry journal.